Today I’d like to address a very common misconception that continues to perpetuate online:

The idea that Travel (with Miles) is Free.

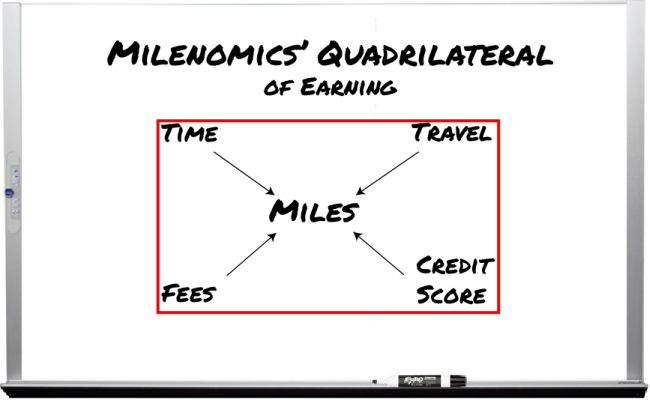

Travel is not free. We’re seeing travel as free when we use Miles to book that trip–but we’ve identified here on Milenomics at least three ways that those miles cost us money: Through time, travel, and fees. The basics of Milenomics are that the investment of time and resources allow us to travel for greatly reduced prices using miles. In addition it allows us to get more for our travel budget. But make no mistake–no one is flying for “free.”

Using Miles Instead of Money ? Free

At the very least you’ve decided to take your miles and points and use them towards travel. This is no different from someone who took their Amex MR points, bought a television with them, and called that a “Free” television. It isn’t. You bought it with your Membership Reward points instead of with cash.

Think of it this way–we’re a community who loves to travel. But there are people who hate it, or don’t have the time for it. Those same people can apply for credit cards and use the points to buy whatever they want. We’ve chosen travel. Maybe they’ve chosen cash.

The Fourth Investment: Your Credit Score

Today we talk about another investment we make to earn our miles: the investment of your credit score. Just like any type investment, your credit score can pay off big time. Not only are the gains not [yet] subject to taxes, but the amount you can earn per year can be massive. Even if you choose to find useful reviews here, in the hopes of sorting out your finances, hopefully, this will be a step in the right direction to get this aspect of your life back on track. You may find that sorting out your credit score isn’t as hard as you initially think. For example, you could apply for payday loans online with no credit score and use that to build up your credit over time.

What you’ll find with a lot of people is that they all want to find 6 Ways To Raise That Credit Score, but they aren’t actually willing to put in the work to help their credit score grow over time.

Banks want your business. Just like any other company they sell a product: their credit cards. They want you to sign up for the card, spend on it, running up the bill, and paying high fees/interest rates. They also make money on the initial charges you place on your credit card–sometimes referred to as the interchange fee.

Take away their interest and fees by paying the bill in full each month, and you’ve got the basics of how to earn miles for cheap. You charge up the bill–pay it off, and the Miles are yours to keep. This is the standard Milenomics Mileage Run (MMR).

For those with very good/excellent credit, 1-4 times a year we should be applying for new credit cards. Milenomics calls this quarterly application process the “Credit Card Calendar.” And it allows us to earn 30+ Miles per dollar all year long.

Mile and cash bonuses are how we monetize a credit score. No other three (at least I hope its three!) digit number can unlock as much potential savings as your credit score. Most people know that a good credit score will unlock [car] doors, or allow you to buy a home. They don’t know that you can monetize that score pretty regularly, to the tune of thousands of dollars per year.

Note: The two main types of credit cards are mile or point earning cards, or cash back cards. They both have a place in your wallet, and both are keys to Milenomics. Having the right mix of Miles is important. We often hear blogs talk about a credit card and mention that it offers XX,000 Miles as the signup bonus. If you sign up for the card, and get the bonus and never do anything with those miles your signup bonus was, in reality, a big 0.

If you’re following along from our first session in September (Fall) you should be nearly complete with your spending on the cards you applied for, if so your bonus miles should also be posting soon. As you now see, this is the single best way to earn major miles.

While you can participate in MMRs without having great credit, signup bonuses are the most lucrative way to earn miles. They do not usually have the expense of MMRs, there’s no driving around town, buying tens of thousands of dollars in financial instruments, and no messy bookkeeping to worry about. Monetizing your good credit can be the single biggest source of miles you earn in a year.

How Milenomics Views a Credit “Score”

When Milenomics talks about credit “scores” we’re not talking about a contest. We’re not comparing our own scores to anyone else’s. If a score is high enough to open the cards you want, and you’re not looking to qualify for a home loan anytime soon–then your score is “acceptable.”

What is acceptable? Probably 720+. I say “probably” because banks decide whether to offer you a credit card not based just on your credit score. At some point, no matter how high your score, they’ll say you have too much credit with them. When they do, you can move around credit on current cards, and try to get the new card open. Sometimes they decide that you’ve applied for too many cards too quickly, and in doing so they say “no” to your application. Regardless of your credit score, they’ve decided for internal reasons, to not extend you the credit card offer.

Think of scores as being in tiers. Once your in the top tier it doesn’t matter if you’re at the very top of the tier–or in the middle of the tier. You’re in. In fact a Credit score that is too high means you’re likely under-monetizing your “score.”

Credit Score vs. Credit “Score”

I’m using “score” in quotes because credit scores aren’t all created equal. When most people are talking abotu a true credit score, they’re talking about a FICO (www.myfico.com) credit score. FICO looks at your credit report, and puts together a score based on many factors such as available credit vs. utilized credit, number of hard pulls, late payments, or delinquent marks.

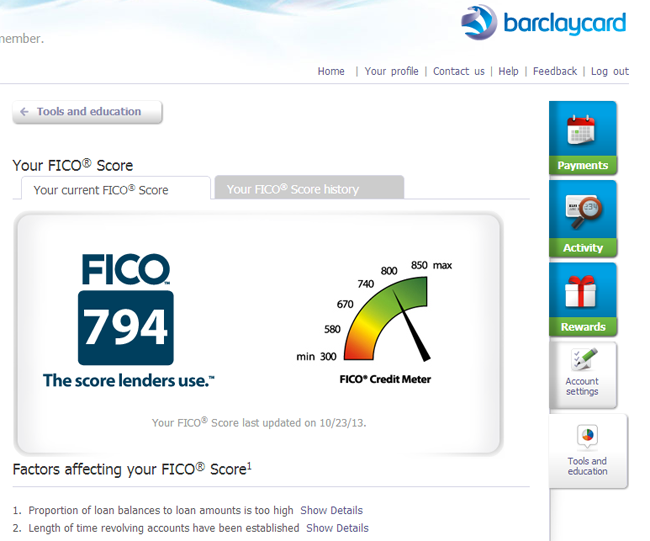

Reccently Barclaycard announced that they would be offering FICO scores for free to all their cardholders. I signed up here: http://bit.ly/1b6KHb8 and pulled the score:

The exact format FICO uses to grade and score is somewhat a mystery. But there are ways to approximate, and an entire industry, sometimes dubbed “FAKO scores” has come about. I want to be clear here: There’s nothing wrong with a FAKO score. Sure it isn’t EXACTLY your FICO score. As we discussed above Milenomics doesn’t concern itself with an absolute score. The number is important–to a point, but then once you’re in the top tier it becomes less important to keep it at the absolute top of that tier.

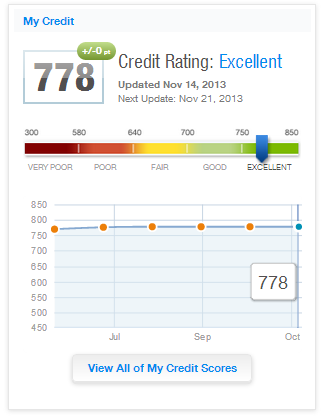

For FAKO scores I highly recommend a service called Credit Karma (www.creditkarma.com). The service is 100% free. Once a week you can pull a FAKO score, based on your TU report, one of the big three credit reports. Sure this number could be off by 5-30+ points. But it gives you a baseline, and a pretty good approximation. As you can see here:

The way that Barclays is representing the score–as a Minimum/Maximum gas tank is misleading. Creditkarma on the other hand breaks your score out, and then gives it a grade. For Credit Karma these grades are:

Excellent: 750+

Good: 700-749

Fair: 640-699

Poor: 580-639

Very Poor: Below 580.

I like this type of grading because it shows you that if your score is 790 or 770 you’re in the same “band” and have proven to be excellent in paying your creditors.

The Next Time You Hear “Travel is Free”

Remember that it isn’t. You’re either earning your miles with Milenomics Mileage Runs, buying seats on flights, or monetizing your credit score. Milenomics is about both MMRs and Monetizing credit scores with the Credit Card Calendar.

When you think of travel as free you lose sight of the cost your miles have to them. When you think miles are free you run the risk of making bookings that are less than ideal–like paying more in miles and fees than you would have to just buy the flight.

When your miles start to have a value–you only use them when the benefit ouweighs the value you put into them. That value will also allow you to stop yourself from over-earning and generating miles you don’t need. Yes, you can have too many frequent flyer miles.

—

If your score isn’t high enough to apply for cards just yet check back tomorrow–when I’ll have a post on how to get into this game with less than stellar credit. And start working to clean up your credit! As I’ve shown today your Credit Score is a valuable tool in earning Miles and money. Once you start monetizing your credit score you’ll want to take good care of that score, which will only continue to take good care of you.