We were debating recently on the podcast what the best all-around travel rewards credit card is these days. The one card to get if you’re going to get just one.

The City National Bank Crystal Visa Infinite was our favorite and the Amex Hilton Aspire a close second (referral link, read this before applying). But there’s another card lurking in the shadows behind these that you’ve probably heard of – but may have forgotten about. The US Bank Altitude Reserve Visa Infinite.

The US Bank Altitude has a name nearly as long as the “royal” CNB card, and a similar value proposition. If you haven’t applied for it yet, it may be because:

- You have to be an existing US Bank customer to get the card

- You’re out of the US Bank service area

- You’ve heard that US Bank is tough on approvals

- You’ve heard that US Bank shuts accounts for manufactured spend (the Altitude gets 3x for mobile wallet transactions)

I’ll work through each of these points today. I think this is a great card that should be on everyone’s radar.

Pros

- 50,000 point signup bonus (with 1.5 cents per point of uplift towards travel = $750 in value)

- Real-time reward redemptions (which enable you to redeem points while booking directly with travel providers, no clunky portals needed)

- $325 easy travel credit (per cardmember year)

- 12 Gogo inflight WiFi passes

- 3x on travel and mobile wallet purchases

- Usual premium card features (TSAPre/Global Entry reimbursement, Priority Pass, metal card, etc)

Cons

- $400 annual fee (not waived the first year)

That’s $750 + $325 = $1,075 in easily redeemable travel for a $400 annual fee the first year.

If you take advantage of the $325 credit in the second cardmember year (ie, 13 months after getting the card) that’s $750 + $325 + $325 = $1,400 in travel for a $400 annual fee the first year.

So I can see my way to this being a $1,000 signup bonus. Plus Gogo passes, and 4.5% back towards travel anywhere that accepts mobile wallet payments.

Getting the Card

There’s a lot of stale information floating around out there about this card. You do [still] need to be an existing customer.

To become an existing customer you can:

- Open a deposit account (here’s a $300 signup bonus) -or-

- Open a different US Bank credit card (then apply for the Altitude later)

The problem I had with opening a deposit account is that I’m outside of their service area. I tried a year ago, but my application for a deposit account was declined.

And the problem with applying for a US Bank personal credit card in order to become eligible for the US Bank Altitude card is that you’ve just applied for a card and you might want to wait before applying for another. If you think their approval standards are tough in the first place this seems like a bad path to go down if your real intention is getting an Altitude card.

However, both my wife and I have US Bank business cards. They sent out targeted offers for $500 signup bonuses on the US Bank Business Edge cards – maybe you went in on these too? If so, you can get approved using one of these two methods…

Method 1: Applying In-Branch with an Existing US Bank Business Card

We were on vacation in Arizona a couple of years ago so I stopped in at a US Bank branch.

Because I already had an existing US Bank business card I was able to apply and was approved for an Altitude card. SUCCESS.

Method 2: Applying Online with an Existing US Bank Business Card

For my wife I didn’t really like the idea of asking her to go in branch while on vacation in US Bank’s service area.

The conventional wisdom seems to be that you need to have an existing personal account (deposit -or- credit card) in order to get approved for the Altitude card. This is not true in my experience.

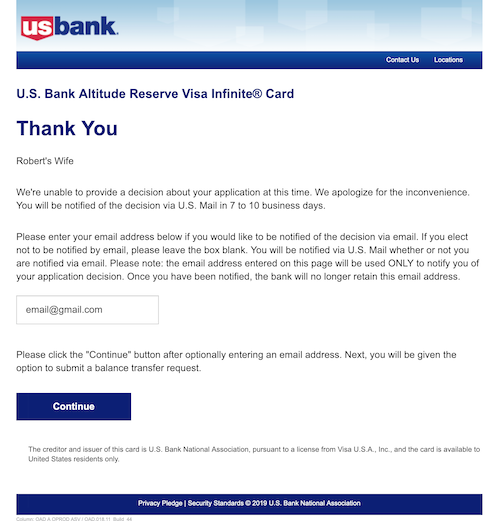

My wife applied for an Alitude card online while having only a US Bank business credit card. Her application went pending with a message that she’d be notified in 7-10 days. 4 days later, her US Bank Altitude card arrived. SUCCESS!

I was surprised actually, because she didn’t call. And even though she provided her email address to be informed of their decision she never heard from them. She just got the card in a timely manner in its fancy welcome packages.

Bottom Line

There are a lot of different playbooks here, but I think the US Bank Altitude card is worth getting.

Although you need to be an existing US Bank customer to get the Altitude card, it’s worth becoming a customer.

If you’re in the US Bank service area, I’d open a checking account for the signup bonus then apply for a US Bank Altitude after the checking account gets established.

If you’re outside the service area and have an existing business card I’d go ahead and apply for the Altitude card online. It seems they’ve gotten smarter about confirming that customers who hold small business credit cards are indeed existing US Bank customers. If you travel regularly through their service area and it’s convenient, stop in and apply for the Altitude. They were pleasant and professional.

If you’re outside the service area and have no relationship with US Bank, I’d seek to establish a relationship with them. If you’ve got a small business I’d start with the best US Bank business card I could find – preferably a targeted offer if you receive one. If not, I’d go for some other US Bank personal credit card that looks appealing for your travel needs. Then apply for the Altitude say 6+ months later.

US Bank’s approval standards haven’t been as difficult as I’ve heard them to be. No freezing of obscure credit reports was necessary. I didn’t need to call to remind them I was a customer.

As for shutdown concerns surrounding even moderate use of mobile wallets for gift card purchases – I haven’t attempted many mobile wallet transactions at all. The card hasn’t proven to be the reliable manufactured spend monster some hoped for. I think the card is strong for easy rewards towards travel without funny business. And as mobile wallet acceptance becomes more common this is a good card for 4.5% on real spend.

I think the US Bank Altitude card is a winner.

i thought you were going to talk about shutdowns, MS and meeting spend

I thought you were going to discuss the manufacturer spending concerns as well?

I have the card but I am pretty nervous about using it for MS due to all of the shut down stories from back in the day

Thanks for the reminder – I forgot to circle back on that point.

Just added the 2nd to last paragraph to the post.

I haven’t tried, and don’t know what’s going on there in practice.

+1

Something that has been very helpful to me recently is FM’s Ultra Premium spreadsheet tool that he published a few months back (and has not mentioned much since). It provides users with a way to assign a personal value to the benefits of each card in order to determine whether or not it’s worth keeping.

For me, the Altitude Reserve’s lacks good benefits. It’s Priority Pass is a joke, as is it’s travel insurance. And the 3x travel is , for me, matched by a couple of other cards I have (so no incremental value).

So, maybe for one year, but not worth renewing. And, looking back, for P2, I had to open a savings account to establish a relationship first. Kind of a hassle when there are better cards out there. But to each, hos own…

I thought it was a one and done card too, but I got a 10,000 point retention offer so I’ll keep it another year so we’ll see.

Agreed that a lot of the characteristics are duplicative but the value prop is pretty straightforward here.

$1,000 in unrestricted travel from a bank that’s not Chase/Amex/Citi gets my attention.

Could you provide a link to the spreadsheet? Thanks!

https://frequentmiler.boardingarea.com/which-ultra-premium-cards-are-keepers/

Priority Pass is good at Capers Cafe/PDX…..good for those take on board goodies or a fair quality sit down meal. I give my P.P. to my kids when they travel PDX……they only look to see if the last name on boarding pass matches the card name.

I’d actually argue that their priority pass is one of the better ones for people with families. They actually allow up to four guests where others are limited to one or two. I recently used it on a family trip at MSP where my wife, two kids, and I got $25 credit each to use at French Meadow bakery and café.

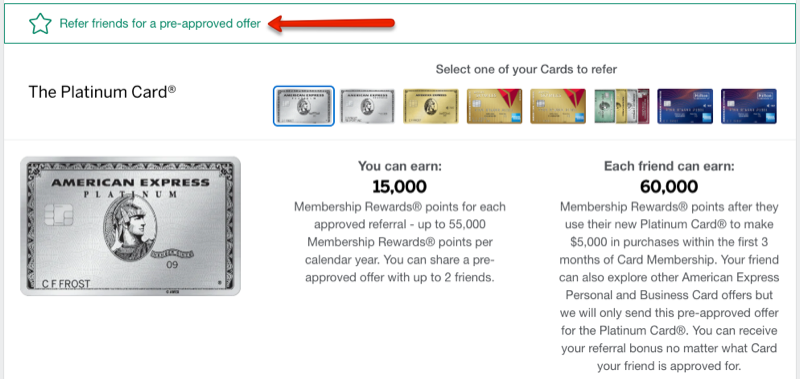

I understand that you are just doing advertisement for the credit card. But what about Chase card or American Express platinum card? At least compare this card with the other two cards.

They both provide the same perks and less hassle to get them.

Hi Robert,

I opened a cashplus card about 2 weeks ago in anticipation of getting the Altitude Reserve in August, but I noticed today I have a pre-qual offer for the Reserve, and the sign up bonus is listed in the benefits. Have you found any datapoints saying pre-qual offers override the 6 month rule?

Hi Ell,

Good to hear you saw this pre-approval.

US Bank does not have a hard 6 month rule.

I was just suggesting it would be wise to wait some time between applications, as you would with most banks.

But if you’re pre-qualified it would seem they’re giving you a green light of sorts.

Let us know how it goes if you apply?

-Robert

Hi Robert,

So far so good. I applied and received the card, and I screenshotted the bonus offer page. I’d be glad to update you once US Bank confirms I will receive the bonus after I hit the spend (that will probably take me 3 months)

Hi Robert,

Just want to say I’m a patreon member for your podcast. I love listening to it!

I also have a question about the altitude reserve card but concerning the sign up bonus. I closed my first altitude card account back in August of 2018. I then reapplied in December and was approved. I met the minimum spend but the points didn’t post.

I emailed them twice about the missing points and both times they said I had met the minimum spend and I just needed to wait 6-8 weeks for the points to post. After 8 weeks had passed I emailed again and this time they said that I am not eligible for the sign up bonus because I have already received a bonus on my first altitude card.

My question is do I have any recourse? Can I fight this? If yes, any suggestions on how? Thanks for the help!

That’s a bummer they don’t want to pay the signup bonus when they told you previously that you just had to wait 6-8 weeks.

On one hand the T&Cs are clear: “The bonus is not available to Cardmembers who currently have, or had, a U.S. Bank Altitude Reserve Visa Infinite account.”

On the other if they told you that you’d get the bonus and you might have a shot by way of a CFPB complaint *if* they told you in no uncertain terms you’d get the bonus. You might be putting your relationship overall with the bank at a risk with this approach though.

If it were me, I’d probably just take the loss and move on, though as you’ve probably seen some have had different results:

https://www.uscreditcardguide.com/us-bank-altitude-reserve-credit-card/

Best of luck, and thanks for listening to the show.

my spouse has the business edge and added me as an AU. Do you think i would qualify for the altitude reserve or its only for the primary cardholder? i obviously live outside of service area and had a hard time getting card for my spouse (had to send tax returns after initial rejection). i am sure if i were to apply for a business card, would have to go thru the same loop.