This week’s Brandon Asks comes from Brad who asks:

“You mention uplift several times in this article but I don’t know what that is. What is it, and how does it help the points and miles game?”

Thanks for asking. If you were confused by the term you’re probably not alone so I’m glad to have a chance to explain and expand on the subject.

Uplift is the amount of value achieved per point when redeeming points for an award.

I most commonly use the term when referring to bank points, especially Chase Ultimate Rewards (URs) and Citi ThankYou Points (TYP), because their points are worth different amounts depending on what you’re redeeming for and which cards you have.

The uplift I’m referring to is relative to a penny per point of value you’d get if redeemed for cash back.

Uplift is particularly compelling in a rewards program with:

- Multiple cards that earn rewards in the program

- Healthy signup bonuses

- Cards which handsomely reward spend

- Cards which provide uplift when redeeming for travel

- The ability to freely transfer points between cards and/or accounts

A Simple Example

Let’s take Chase URs for example, since they’re the industry leader. Say we sign up for an Chase Ink Cash small business card for a 50,000 point signup bonus.

Then we meet the $5,000 minimum spend requirement entirely at office supply stores which is a 5x category on the card. We’d have 75,000 points: 50,000 from the signup bonus + 25,000 for the 5x spend.

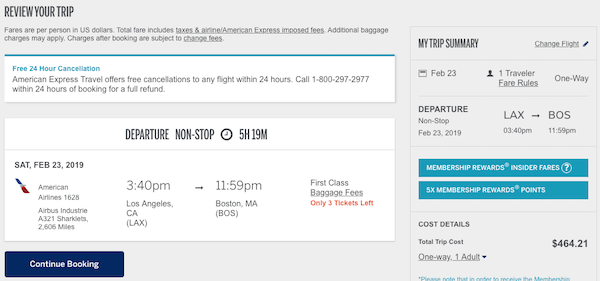

Those points can be cashed out for a penny a point so we could get $750. Or we could get 1.25x uplift ($937.50) if we redeem towards travel through the Chase UR portal.

But if we also had a Chase Sapphire Reserve personal card we could transfer our points from the Ink card to the Sapphire Reserve so we’d get 1.5x uplift making those 75,000 URs worth $1,125.

By maximizing the value in each program we can derive a lot more value than by just focusing on each individual card.

A More Complicated Example

The Citi AT&T Access More card earns 3x TYP at certain online retailers. If you also have a Citi Premier card you get 1.25 uplift for travel booked through Citi. But if you also have a Citi Prestige you can get a 4th night free on hotel bookings.

It’s complicated in itself to determine whether this results in 1.67x uplift (Frequent Miler tried). But it’s even more important to step back and scrutinize whether the price you’re paying when booking through the bank portal is truly the rock bottom price you could achieve if booked directly:

- The prices through the bank portal might be higher than booking direct

- What elite benefits/point accrual might you be giving up by booking through a bank portal?

- Could you book through a shopping portal for additional points/cashback?

- Could you book through Hotels.com for 10% rewards?

- Could you book through a Virtuoso travel agent for daily free breakfast and other amenities?

- When booking a cruise, are you giving up an onboard credit you could have had if booked through a travel agent?

My point is this: To determine how much uplift you’re truly getting when redeeming bank points, but sure to calculate your cents per point of uplift by comparing the rock bottom price you could realize divided by the number of points redeemed.

This is why some people avoid using bank points for anything besides airfare. Because it’s hard to get a discount on airfare when paying with cash, and conversely it’s hard to book a hotel or cruise through a bank portal without forgoing some kind of discount you could get by booking through another channel.

Other Types of Uplift

Uplift could generically refer to simpler scenarios that don’t include booking portals or even travel. An example of this would be combining the AmEx Blue Business Plus card which earns 2x Membership Rewards with a Charles Schwab AmEx Platinum card that provides 1.25 uplift when redeeming for cash into a Schwab brokerage account.

That’s a nice 2.5x everywhere scheme, but keep in mind the fees you’ll have to pay. Although the Schwab card’s $550 annual fee is offset by a signup bonus and other benefits, getting the uplift does have real costs.

Summing it Up

Uplift is a valuable tool in this game we play.

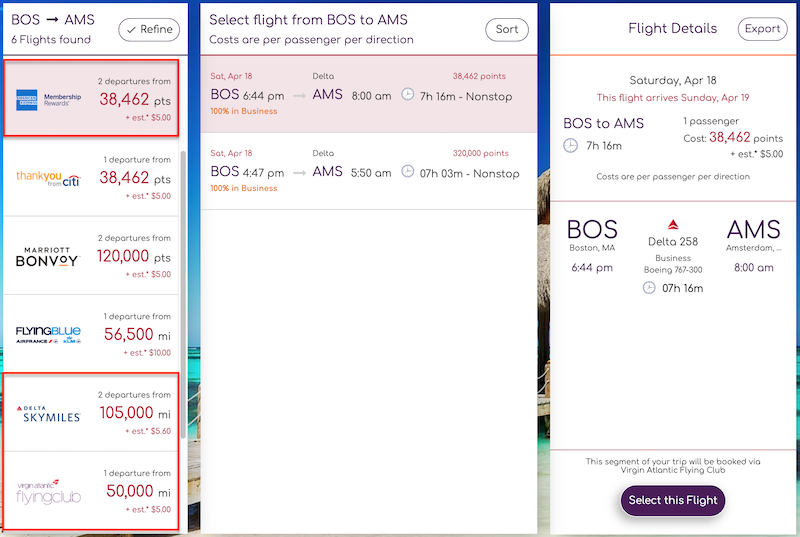

Cashback cards are appealing for their straightforward value proposition, but uplift when redeeming bank points can be a terrific option. Not to mention the larger upside that’s sometimes achievable through 1:1 transfer to travel partners.

See: Ranking the Best Bank Point Programs in 2018

Use uplift wisely: Take advantage of co-mingling points within a program, and take the trips you really want to take with as much uplift as possible if traditional award availability is scarce.

And be honest with yourself about how much value you’re getting per point, especially when redeeming bank points. It’s rare that you can’t get some sort of discount when booking directly with cash and this should be factored in when determining how much uplift you’re truly getting.

I hope this helps, and thanks to Brad for asking.

If you’ve got a question or award booking challenge you’d like us to take on drop us an email or hit us up on Twitter @Milenomics

When I look at the bullet list of things that should be considered (i.e, ‘even more important to step back and scrutinize whether the price you’re paying when booking through the bank portal is truly the rock bottom price you could achieve if booked directly:”). it makes me jut throw up my hands and say “What’s my time worth to go through all that?”

Personally, this describes me and I do waaaaay more comparisons than I think is healthy. And all for, what, 10% maximum return?

It’s a really good point you make, @bluecat.

Hopefully we can perform some of these conceptually then store them for future conceptual application.

For example, if I say “I’ll only use bank points at hotels that don’t have loyalty programs” and “I’ll use Citi TYP if it’s 4 nights since I have Citi Prestige, else Chase URs”.

My hope in raising these considerations is that I think there’s merit in “living the bank point lifestyle” but there are important things to keep in mind.

If we’re playing this game effectively we’re establishing such a big spread between the value we’re getting vs the cost of point acquisition that we can sleep well at night even if we “eat” the 10% differences and avoid the anguish of fully working the math out/wasting time fully exploring the equivalent cash booking comparison point.

Thanks. I’m challenging myself more to just not worry about that last 10%.

It runs a little counter to this points game, so it is a challenge for me. ?

Funny, I was thinking more of the science fiction Uplift, but this is good. 🙂

Or maybe, I don’t know, just use standard terminology that a layman could understand?