We’re trying out a new segment here on Milenomics: Shop Talk. Think of it as a ‘podcast on paper.’ We’ll discuss what’s going on in our personal points & miles space as well as highlight what we think is interesting in the broader space as well. This is the kind of “Shop Talk” many of you are engaged in daily as well, so feel free to discuss with us in the comments section.

Banter

What have you been up to personally in the points & miles space recently?

Robert: A trend I’ve noticed lately is a lot of targeted offers for business cards. I wrote about this recently in Five Ways to Unlock More Credit Card Signup Bonuses.

I’ve spent the past week tinkering with a targeted AmEx offer that arrived in the mail. Frequent Miler wrote a while back that he’s noticed an uptick in targeted offers from AmEx that lack these exclusions. For as much as AmEx says their bonuses are once per product lifetime it’s nice when you can find ways around this.

But what if you aren’t so fortunate to receive a targeted offer? From what I’ve read on the topic (this post for example), if you can somehow “find” a single-use RSVP code for an AmEx card that doesn’t have the “Welcome bonus offer not available to applicants who have or have had this product” language it might be successfully used by someone other than the intended recipient even though the T&Cs suggest otherwise. There’s even a grey market for these RSVP codes. Definitely Risky Business kind of stuff but it could be worth a shot if you’re up for a challenge.

How about you, Sam?

Sam: Funny that you brought up business cards, I too seem to have been focusing on those since the first of the year. One of your earliest posts here on Milenomics was an excellent recap of the Wells Fargo Business Platinum credit card. These were links I think you found before anyone else, and are worth considering as they still work.

I documented my inability to get anywhere with Wells Fargo on this card. I mistakenly thought that my inability to get the card was due to a blacklisting by WF. But it was actually due to something I did back in December.

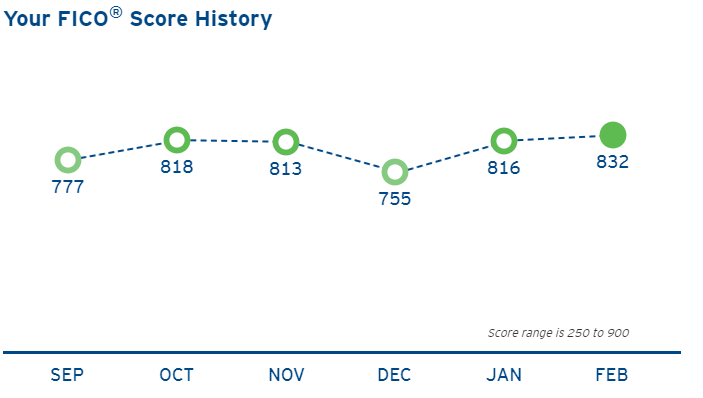

Late last year I was playing around with seeing which issuers would allow me to move my credit limit between cards. Without thinking about it I had a card actually close with an over 100% utilization. I mistakenly went over my limit and let the card statement cut. This had a crazy effect on my score (crazy bad, not crazy good):

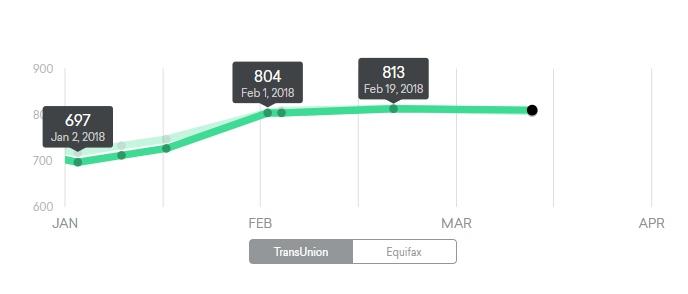

The above score updates all occurred on 23rd of each month, I think this chart missed the truly dramatic drop (105% utilization closed Dec 16th. Here’s Jan-March from CK:

In January I must have looked like a severe credit risk (to a computer). I fit the ‘he’s maxing out his cards, must be hitting a really rough patch’ pattern. Then a few weeks later the computers caught up with me and said “oh yea, never-mind, he’s good.”

Once I figured out what was going on I waited until my January applications aged out (30 days) and reapplied and was approved for it late Feb. I also went for a Citi Business card, and then roped into a Citi personal card app. Strangely all the minimum spend is done on those cards *except* for my wife’s Wells Fargo Business card. I’m $40 short on that card with another month to go to hit the $5,000. I find I have to be less aggressive with my wife’s cards.

I also had a good time talking with Joe and Trevor on the Saverocity Observation deck podcast. We got a little too caught up in talking so I think there will be a part 2 coming soon as well.

I know I mentioned this to you already Robert, but I spent the last few days in love with this Vons/Safeway 10x Fuel rewards on Best Buy GC purchases. There’s actually another week left in the promo, and Danny’s site actually has incorrect information — it is limited to one use per purchase but allows unlimited total purchases over the period ending March 20.

I also put the finishing touches on my upcoming Kauai trip, which is fast approaching. I know you and your family just got back from WDW, any other upcoming trips planned?

Robert: I’m looking very forward to that Saverocity Observation Deck episode. I’ve been listening to that one from the beginning. Podcasts seem to having a renaissance of sorts and I do find them enjoyable. I noticed Pizza in Motion started a podcast. I checked out the 2nd episode with Mommy Points and thought it was good.

I’m headed to to California this week for work, getting out of town before yet another storm hits Boston. It’ll be my first time flying with United Silver – can’t wait to enjoy that Economy Plus middle seat (I’m currently #32 on the upgrade list for First).

You may have noticed me asking Virgin Atlantic why they don’t allow booking child award tickets online even when they’re traveling with an adult. I was looking to book some Boston to Cincinnati flights that have been pricey since only Delta operates the routes. Like I was saying in this post I’m trying to get more comfortable holding off on booking flights until closer to travel dates.

I saw a couple things I hadn’t noticed before. First, Delta wanted 26,500 pp one-way in First. Or 48,000 round-trip in First. Usually I see the domestic flights are the same price when booked as two one-ways so I was surprised to see savings when booked as a round-trip.

Second, I was able to book it using Virgin Atlantic miles for 45,000 pp roundtrip in First. I’ve got like half a million Virgin Atlantic miles between me and my wife (from several BofA Virgin Atlantic signup bonuses when they were more friendly about approving cards) yet I’ve never redeemed a single one.

It wasn’t so much about saving miles (45,000 Virgin Atlantic vs 48,000 Delta isn’t a big difference and I could have used ~43,000 Membership Rewards for the ~$650 roundtrip tickets) as it was finally using some of the Virgin Atlantic miles.

Sam: I can’t argue with that, better to get some value out of them than let them sit forever on a ‘what if.’ There’s a nice piece by Richard over at TPG about his use of Virgin Atlantic miles on Delta as well. Readers might find useful if they’re stuck with a pile of those miles like you are Robert.

News

What news in the points & miles space caught your attention lately?

Robert: AmEx refreshed a lot of their signup bonuses for the beginning of March. Their co-branded Delta cards are at all-time highs (70k/60k)as is the SPG Business card (35k). They were nice enough to bump the referral bonuses on these cards at the same time so it’s a good opportunity to potentially sign up then refer a spouse while you’re at it. I think the SPG offer in particular is strong, especially since that card is on death row with the Marriott/SPG merger progressing.

Sam: Just a shameless plug here, we have a “referral links” tab along the top of all pages with pertinent links that support Robert and I, including the cards Robert is talking about here. I’ve found it to be a slow news week personally. I don’t know if I’m just not totally immersed this past week or it is in fact a slow one. I did enjoy the chatter that comes from true elites who are “all in” on an airline having to swallow negative changes, so I got a little bit of schadenfreude over United’s embrace of BYOE with their $9 early boarding charge . Not that I think it’s worth paying, but it is rather funny that $9 is the amount here. They’re telling UA elites “you’re worth $9 to us before you board, and anyone who has $9 is just as valuable as you are.”

Anything else particularly good in your view, Robert?

Robert: I thought FQF’s post on a sneaky way to cash out MRs at 2.5 cpp was brilliant. That’s an interesting example for calculating the Net Present Value of a deal. It sounds great on paper but suffers from limitations in Scale, Time, and has a high Probability of Malfunction. So I will mostly admire the ingenuity from afar. But I love how it shows a different way of looking at a puzzle.

Sam: Ahh, you published the NPV piece. Awesome. So now I want to re-write the above paragraph about it being a slow week. I absolutely love that post Robert. I’ve batted around in my head some of the limitations it illustrates (scale and time) but never so elegantly. Not only do I think everyone who’s heavily invested in this space can use the idea, but I think that readers can use that NPV equation for two really important reasons. First, they can ‘spot check’ a deal to see if it makes sense for them, and second they can tweak things like the time or scale to try to turn a pretty bad deal into a winner.

Join the Conversation

What’s had your attention in the points & miles space lately? Leave a comment below or ping us on Twitter @milenomics and @RobertDwyer with your thoughts. We’d love to hear from you.

Are you at all concerned with the supposed uptick in Chase shutdowns against those with multiple new cards from other issuers, not just Chase?

Thanks for the question Dave. Personally, no I’m not. I would consider changing something I was doing with Chase cards if it was shown to result in a Chase shutdown. But I won’t change what’s financially best for me from all other issuers on a possible ‘what if’ from Chase. Another way of thinking about it is to argue: “Is chase worth more than all other card issuers combined?” In my opinion no, they are not. I wonder if Robert feels similarly or not.

I haven’t heard of this myself – do you have a link where this is being discussed, Dave?

Conceptually this reminds me of the question of whether to MS with Chase given how lucrative their overall rewards program is. Part of the reason Chase is so valuable is their cards that bonus spend so heavily. If you don’t take advantage of that aspect of their program then, well, their program isn’t as lucrative as it could be.

Similarly if we stay under 5/24 to get new signups for them those signups need to be worth more than the card from other banks you’ve forgone to get under 5/24. I might consider going there if I run dry on compelling offers from other banks, but I haven’t gotten to that point yet.

And sometimes you get lucky and get can an Ultimate Rewards card even when you’re well over 5/24 (targeted offer in-branch for example).

You mention purchasing Best Buy cards (W/HHONORS Amex 6X?) and 10x Safeway gas rewards….what/how/why to you use the Best Buy GC’s for?

Thanks for the comments Portland. As for the Best Buy cards, I’m selling them to a GC re-seller. I am also buying Visas while I’m there (for scale and to maximize my use of time). On just the best buy cards the math is: 5% back on the purchase + $1 per gallon x 15 gallons (15%) and sell for $91 per $100 (-9%). Net 11% per $100 in BBuy cards. Like I said it isn’t phenomenal because there’s an upper limit–how much gas do you use between now and the end of next month.

I’m able to scale around that a little by selling the gas points at 50% off of 25 gallons ($12.50 per $100). Even that has a limit, restricted by my connections and ability to sell those. That makes the math on the balance even worse, 5% + 12.5% -9% = 8.5%.

If that was all I was doing it wouldn’t be worth my time, especially because these are limit one per transaction, but these BBuy cards also seem to declaw those crotchety older cashiers and have let me slip large Visa GC purchases through at a store which had been anti CC for those for quite some time. I’m hopeful the relationships built at that store will carry me into Q2 with my multiple chase freedoms.

Good post today

thanks

So for what it’s worth, I did a couple of tax payments on an AMEX where I went 50% over limit — with AMEX’s full preapproval using their system.

When a statement closed showing one of those, the effect was a 150-point FICO hit. No exaggeration!

Don’t let this happen to you!

Thanks for the comment Mark. Was the score rebound as quick for you as it was for me?