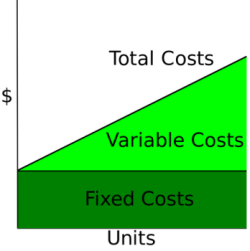

Would you run your business without an idea what your input costs were? I’m sure some business do–but I can’t see that working out. This is the reason Milenomics values Miles based on all our inputs including time and travel. Doing so allows us to know what our total cost(TC) per mile is.This seems unimportant to most people–you know that you’ll pay $3.95, $4.95, or $5.95 for whatever you buy as part of your MMRs, and you’ll earn 500-1500 miles for that purchase. Easy math: $3.95/500 miles means you paid $.0079 per mile. This is your fixed cost.

The reason this doesn’t work is that it is only scalable to a certain point. You can discredit your time and travel sometimes–but if you drove every single day to a your closest CVS, and 3 our of 4 days the cupboards were bare, what then? what about 9 out of 10 days. Or what if you can’t drive, and instead you live in a big city and rely on public transportation?

When you finally make it to the store the day they restock and buy your ice Cream has it still cost you the same $.0079 per mile? Some of you might say yes, but I argue that it doesn’t. These are your variable costs.

Without cost tracking you might also be hit with the staples effect as part of those first failed runs as well. Buying higher fixed cost goods due to your first choice purchase not being there. (named after staples and their magic disappearing gift cards). Make sure this doesn’t happen by removing inefficiencies in your MMRs.

Today is the first post in a series on ways we can reduce our cost per mile.

Spacely Sprockets, Cogswell Cogs & Milenomics Manifolds

Spacely Sprockets, Cogswell Cogs & Milenomics Manifolds

Did you ever watch the Jetsons? If so you remember that George worked at Spacely Sprockets and Cogswell Cogs was their competitor. Why do I bring this up? To challenge you to think up a name for your miles– Ultimate Reward Utensils, or Skymile Sprockets.

I find that it helped me at one point to stop thinking about earning frequent flyer miles–and instead start thinking of them as widgets. It helped cure me of my bad habits (including range anxiety) and cut my costs. This type of thinking might help you too.

When you think about it, we’re really in the business of manufacturing a non durable (or consumable) good. A non-durable good usually has a life span of up to 3 years. That’s a little longer than I’d like to hold my miles, but the basics are the same; You need to be using your miles, not hoarding them. This is another reason I like to think of my miles not as pennies, or some other store of value–but as good old Sam Simon Sprockets. Miles only have monetary value if you can convert them to cash (which can be done, but isn’t always as easy as a few clicks), or if you can book them against travel you want to take.

The Holy Grail of Mile Earning

Imagine for a moment you stumbled upon the ultimate method of creating miles. And lets assume that method cost you very little–the item could be bought and cashed out for $1.00 and net you 500 miles. It isn’t all good news–the item is limited to 4 purchases per store day.

This limit of 4 purchase per day is not the only limit, it is just the only explicit limit. The store is telling you that you can only buy 4 per store, per day. You should be thinking about what other limits exist.

Lets examine possible limits in this test case:

- Limit #1: maximum a store allows you to buy. If a store limits you to 4 purchases your fixed costs are $4, and your variable costs would be divisible by 4.

- Limit #2: Credit card Adverse Activity from large purchases at stores. Hard to put a number on this–but there’s a limit, somewhere. I’ve exceeded my CL 2x in a month without issues, but don’t like to tempt the beast anymore.

- Limit #3: Your time. If you found the golden goose and there really was no limit could you go to 10 different stores a day? 20? 30? Eventually you’ll start to answer no because the stores are too far away, and the amount of time you’d take to get there and home wouldn’t be worth it. Even if there was no limit based on the value of the good there’d be a limit on your hours. Could you quit your job and work 9 hours straight on Milenomcs Mileage Runs? Maybe. Should you do that? Almost universally not.

- Limit #4: Cash Flow. This is can be an issue for certain Mileage earning schemes. You can usually increase cash flow by utilizing the float from earlier purchases–but that too has its limit. (and bumps up against Limit #2)

Knowing these limits, lets examine how to remove inefficiencies in each area as best we can.

Limit #1: Purchase limits

Purchase limits are difficult to get around, but are important to look at. The economics of 5 item per day purchase limit vs. a 2 item per day purchase limit make a big difference when it comes time to tally up the costs. Ways to get around this are to diversify, and also to pool your purchases. Look for other items you can buy to get around this limit, especially at the same store. VR are limited to 5 per day at CVS, but what if VR didn’t even exist? Challenge yourself to think about this.

Also look for stores that are clustered. Your closest CVS might be all by itself–but if one farther away is also next to a supermarket and a Rite-Aid, the extra driving might be worth it if you can divide it by multiple purchases.

Limit #2 Credit Card Adverse Action:

We’ve discussed this twice before on Milenomics–the Icarus Paradox, when Banks clip our wings, and again with the Milenomics Financial Firewall/Setting up Systems of accounts. The basics are the same: press as hard as you’re comfortable with.

The risk of account closure and Adverse Action rises until you pass a FR without any AA, at which point the risk of another one happening are very very low. If you do pass the FR without any issues you can probably go absolutely nuts for 6-12 months. but if you’re not going to pass that FR—tread lightly.

Limit #3 Time:

Time is very precious to me–My time is managed with only a few spare hours a day (more on weekends). Aside from my day job, there’s writing the blog, my volunteer work, and most importantly my time spent with my wife and family.

How do we become more efficient with our our time? This one is hard to pin down. Anyone who’s been stuck at a Money order Machine that is out of paper–or made it to the car only to realize the number on the receipt doesn’t match the number on a reload knows–even the best purchase can turn south quickly.

There isn’t much we can do about these outliers–computer (or human error), and machines malfunctioning. What we can do is plan our trips out–say setting up a loop whereby we hit multiple stores as part of the same trip. Also setting a time limit on your transactions say 30 minutes total means you’re not out there for 2 hours driving from store to store.

Using a loop is the #1 way to save time and money. An additional tip is to find the bank that is the closest to your Money Order Point of Origin (MOPO) and open an account there. There is usually a branch of some major bank or credit union close to your MOPO. Doing this has two benefits–you can deposit right away, and you limit your risk of carrying around thousands of dollars in cash equivalents.

Limit #4: Cash flow

This is the area I’ve had the most frustration with as well as the most success. Cash flow issues are harder to deal with because you can’t just throw more time at them (or discount your T-Rate), more purchases at them (because you might be at/near your limit.) However managing cash flow successfully will be the #1 way you turn your mileage earning up to the next level. Good cash flow management means you’re holding the credit card company’s cash, and playing with it, instead of playing with your money. Bad cash flow management means missing a due date and paying interest charges. Ensure you know what you’re doing before your start down this road.

Having the right mix of bank accounts–those who let you move money around fast is important for Cash flow. Having the wrong mix of bank accounts–or mixing your day to day bank about with your funny business accounts is a surefire way to eventually get caught holding the bag.

A positive effect of learning good cash flow now will be that if/when interest rates rise you’ll be in a position to earn some interest off of that float as well. And if there’s one thing Milenomics loves as much as more miles, it is more cash to go with them.

As always, share your tips for removing inefficiencies in the comments.

And remember: Good habits die hard. Bad habits burn miles and money. Make sure you’re not working against yourself, and be the best Milenomic you can be.

I was browsing through links in recent posts and stumbled across this one. I can’t believe I’m the first person to comment. I appreciate your pragmatic and elegant philosophy. I’m struggling to convince my Dad that it’s not that great of a deal to use his CSP or Hawaiian Airlines cards for VRatCVS. Total Cost and value need to be considered. Thank you!