Note:I added this post to the series on BYOE. This post doesn’t exactly “fit” with the others, but I really enjoyed writing it so I wanted to throw it in here.

Can All Your Flights Be Award Flights?

It hadn’t come to my attention until I wrote the earlier post, “Sunk costs and Adverse Selection,” that this might be the first year I ever fly 100% award flights. I’m close to the end of the year–and unless I decide to go somewhere for Christmas (and can’t use miles) it seems like I’ll clock in 0 total miles from paid flights this year. To me this is the travel equivalent of “Inbox Zero,” and something I like to call EQM-Zero. In trying to reach EQM-Zero we’ll step through an average example, and also use some techniques to save on domestic flights.

EQM Zero-the Hunt for No Paid Flights

Can you get to EQM Zero? Maybe. When I look back on my year it is clear that the main reason I was able to do so is because my dates of travel are incredibly flexible. If you have flexibility, in dates, destinations, or class of travel then your only other hurdle is the number of miles you’ll need. Let’s look at how many miles it would take an average flyer to reach EQM-Zero

Average cost per flight vs. Average Miles per flight

Using the number that Delta and United seem to love, $.10 per mile flown I’ll estimate that if you fly 50,000 miles a year you’re looking at spending $5,000 in flights. I’m very sure you can do better than this. Services like Fare Magnet, and the Flight Deal offer under $.05 CPM flights all the time. In fact, one day last month I even Declared Miles were dead, long live cash fares! (I quickly returned to my senses)

Assuming 15 trips a year, our average number of miles flown will be 3,333 miles per trip. Average cost per trip would then be $350. We’ll use these numbers for the rest of this post.

How Many Miles Are Needed to Reach EQM-Zero

This one is a little harder to pin down. Sure you could just assume 25,000 miles per round trip ticket x 15 flights per year = 375,000 Frequent Flyer Miles needed. If you travel with a spouse this number can double. Digging deeper, can you get the average miles used per flight down lower? I think you absolutely can, and have outlined 5 ways in which you can do so:

- – Southwest:

$350 flights would be around 20,000 WN RR points, when booked as ‘Wanna Get Away?’ fares. This would be even lower if flying as a pair–10k per person with a CP. But for the sake of this post we’ll assume flying alone and/or without a CP. Average cost: 20,000 WN RR points.

$350 flights would be around 20,000 WN RR points, when booked as ‘Wanna Get Away?’ fares. This would be even lower if flying as a pair–10k per person with a CP. But for the sake of this post we’ll assume flying alone and/or without a CP. Average cost: 20,000 WN RR points. - Note: This is changing as of March 31, 2014. Please see Frugal Travel Lawyer’s post about the devaluation.

- – Avios: With an average flight distance of 3,333 miles you’d only use 10,000 Avios each way. Shorter flights would use less, and longer flights could use more, but we’ll go with the mathematical average for this. An Average of 20,000 avios per R/t

- – Hybrid System: If you live in a DL hub and can use the hybrid system to your advantage you can shave half a flight off of 2 flights. That could mean as little as 25,000 DL miles + 7500 avios or less WN RR points. Total 32,500 miles for 2 flights–Average of 16,250 Miles per round trip.

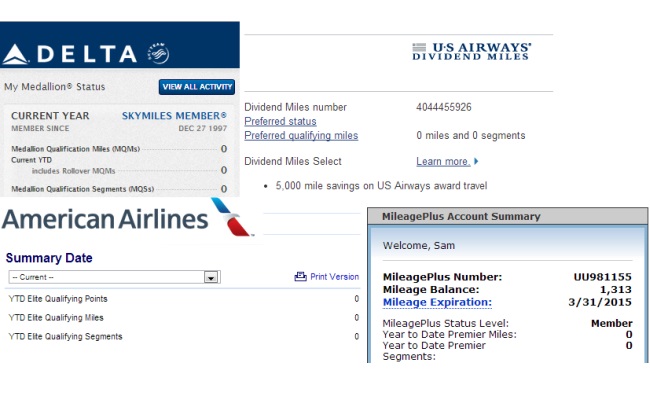

- – American Airlines: American offers reduced mileage awards to certain locations in the United states and Canada for credit card holders. These are 17,500 miles per redemption versus the 25,000 at full price. Furthermore, you would receive a 10% rebate in those miles up to your first 100,000 miles redeemed each year. I don’t recommend using AA miles domestically since they’re very valuable for international trips, but I wanted to include them here. Average cost 15,750 AA miles round trip.

– US Airways: Another I don’t really recommend using for domestic awards because – their miles are so valuable and flexible for international trips. But with the US airways Mastercard (which everyone should have from our CCC Applications) you receive a 5,000 mile rebate on awards flown on US metal. Average cost 20,000 miles per Round Trip.

– US Airways: Another I don’t really recommend using for domestic awards because – their miles are so valuable and flexible for international trips. But with the US airways Mastercard (which everyone should have from our CCC Applications) you receive a 5,000 mile rebate on awards flown on US metal. Average cost 20,000 miles per Round Trip.

Using any/all of these tricks whenever possible could bring your total miles used to reach EQM-Zero down much lower. Assuming an equal usage of all these tricks, as well as booking full 25,000 mile tickets whenever none of the above tricks help, you’d be using an average of 19,500. Is this a realistic number? That depends on your demand schedule, and where you’re flying. For some of us, I’m sure it is, for others I don’t think it will be.

Reaching EQM-Zero with the Above Tricks

Given the same 15 flights above, and using the average of 19,500 miles per we’re looking at needing 292,500 on the low end, and 375,000 miles on the high end to make EQM-Zero happen. This could mean a savings of 82,500 miles. Of course this is theoretical–but it gives you an example to shoot for yourself.

375,000 miles is just over 1,000 miles per day, a pretty good goal to give yourself. That doesn’t mean you should attempt to earn 1,000 miles a day for 365 days. The costs to do so will eat up any benefit you will see. Instead try to group things together, earning as many miles as possible. If you’ve followed the Credit card Calendar you’re well on your way to this 300,000 number just off of our first round of applications.

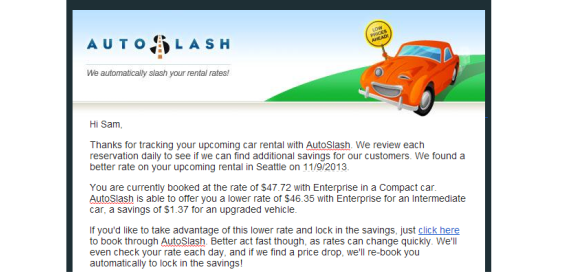

Plan out your trips, book the ones with firm dates using the tips here, and the low level hedge in case there are no low level awards. Set seat alerts, and be ready to book when those seats come open.

Putting it all Together

The biggest benefit to reaching EQM Zero is in the money you’ll save. In our test case we looked at spending $5,000 for our tickets. If we took that same $5,000 and used it all to generate 375,000 miles it would mean an average cost of $.0133 cents per mile. Using the Credit Card Calendar, and some shrewd Milenomics Mileage Runs(MMRs) you should be able to get your actual Cost Per Mile much lower than this. The 196,000 miles we earned on the first round of CCC applications had almost no real cost to them. Assuming you still needed to earn the next 158,000 miles (to get to the full 375,00 miles), even at 1.3 CPM you’d only be spending $2,060 to do so. In reality you might need fewer miles, most of your cost should be your time at your T-Rate, and your cost per mile should be much less than 1.3 CPM.

By reaching EQM Zero you keep more of your hard earned money in your pocket. Lets all focus on getting as close to it as we can, and use the savings to our advantage.

Up next: “The airline equivalent of the free cup of coffee”

Everything below this line is Automatically inserted into this post and is not necessarily endorsed by Milenomics:

Great food for thought. I won’t hit EQM = 0 simply because I do a lot of flying to visit family and that tends to be around holidays or on set dates for weddings or other events. Still, I’m getting much better at using miles to fund my “true” vacations and it’s certainly stretched my travel budget quite a bit. Nice summary overall!

I’ve mentioned this on Flyertalk and Milepoint numerous times re: Southwest.

If you book far enough in advance, you can book roundtrip flights on the cheap. As an example, I booked LGA/FLL for 8040 Southwest points roundtrip. That’s a lot cheaper than Avios and even more cheaper than the legacy carriers who want 25,000 miles.

We just came back from SLC. Roundtrip cost in Southwest points for ~15,000.

I flew R/T LGA/MDW for ~10,000 points.

I could think of worse places to have miles. The good thing is that I get to save my UA/AA miles for a seat upfront.

Get that SWA credit card, and or move some Chase Ultimate Rewards points to SWA. You can thank me later.

100% Agree here. There’s some anti WN bias our there, I’m not sure why. They get you where you need to go, for less. Nonstop on Southwest is as good as anyone else to me. It is also very useful in booking free one ways with other carriers, and factors prominently into the Hybrid System here on Milenomics.

The most convenient part of their program is that if there’s a seat for low $$$’s there’s a seat for low points.

Yikes. If you’re spending anywhere near 1.3cpm, you’re doing MS ineptly. The goal should be closer to 0.3cpm or lower (using cash back cards to offset MS costs). I’ve grabbed close to $10K in cash back this year (or equivalents like TY points used for mortgage redemptions) and >4MM miles. Easily several $K in the black after all is said and done…

Paul: Milenomics approaches MS a bit differently. In that 1.3 CPM is my time, at my T-rate, as well as my mileage driven. This gives me a total spent on those miles-and keeps my eye on getting pure out of pocket $ costs as low as possible. When redeeming I use this value as the floor for a redemption–thus pulling the stored value of my time out of the miles and points earned.

It is a different way to view the game, and one which has helped me greatly. In my real spending I also use double and triple dips whenever possible to get those costs even lower–but those ultra low cost miles don’t scale to infinity, so the low hanging & cheapest (sometimes free, or negative cost) miles get averaged in with everything else. Using cash back for offsetting costs is robbing peter to pay paul–that is cash you could very well keep, but you’re spending it on fees. There’s nothing wrong with doing that–I’ve done it myself–but keeping mileage costs squared away helps when you go to redeem by giving you your own personal value for each type of mile. I also stop churning miles once my demand schedules of miles are met and focus on cash back entirely. No reason to collect millions of miles and let them sit in an account…of course unless you sell that account for Cash that is. 😉 Interested in your views, hope you stick around and read more posts.